Introduction

Learn what it takes to be a Forex trader dealer, how they make money, the required abilities, and the capability for achievement. Forex buying and selling, additionally referred to as currency trading, is a decentralized market where people and establishments exchange extraordinary currencies. It has evolved into one of the most giant buying and selling needs within the international, with an expected each-day turnover of $6.6 trillion as of 2019. Forex buyers are the key players in this market, executing trades and making profits. In this file, we can test the history of foreign exchange trading and how it has advanced through the years, and we can also speak about the future of foreign exchange trading and the function of the forex dealer.

History of the Forex Market Trading:

Forex buying and selling has a protracted history dating returned to historic times. Trading of currencies turned into common in historical civilizations inclusive of Rome and Greece, wherein money changers would assist human beings in alternate currencies for a rate. However, the current foreign exchange marketplace as we know it these days started to take shape within the 1970s after the failure of the Bretton Woods arrangement.

Before the collapse of the Bretton Woods settlement, banknotes were fixed to the United States dollar, which became, in flip, fixed to gold. This intended that the price of currencies turned into constant and did not differ tons. However, the disintegration of the settlement caused a free-floating alternate price system where currencies were allowed to fluctuate freely based on market demand and delivery.

The rise of the era in the 1980s and 1990s caused the improvement of electronic trading podia, which made it easier for traders to get the right of entry to the foreign exchange marketplace. This additionally brought about the democratization of the market, as people ought to now trade currencies from the consolation of their homes.

The Future of Forex Trader (Forex Trader)

The destiny of forex trading appears shiny, with the market predicted to develop even extra widely in the coming years. One of the primary drivers of this increase is the growing adoption of generation within the forex market. Trading systems have become extra cutting-edge, with advanced gear and competencies that make buying and selling easier and extra efficient. This has additionally brought about the rise of algorithmic buying and selling, where pc packages execute trades based totally on predefined regulations.

Another tendency that is attainable to shape the future of foreign exchange buying and selling is the increasing utilization of synthetic intelligence and machine learning. These technologies can diagnose massive quantities of facts and make predictions about marketplace actions, that could assist buyers make better selections. In addition, the blockchain era is likewise expected to play a function in forex trading, as it can assist enhance transparency and protection in the marketplace.

The Role of the Forex Market Trader

Despite the increasing use of generation and automation within the foreign exchange market, the function of the foreign exchange dealer stays important. Traders are nonetheless needed to interpret marketplace statistics, make knowledgeable choices, and execute trades. However, the position of the dealer is evolving, with a more emphasis on facts analysis and change management.

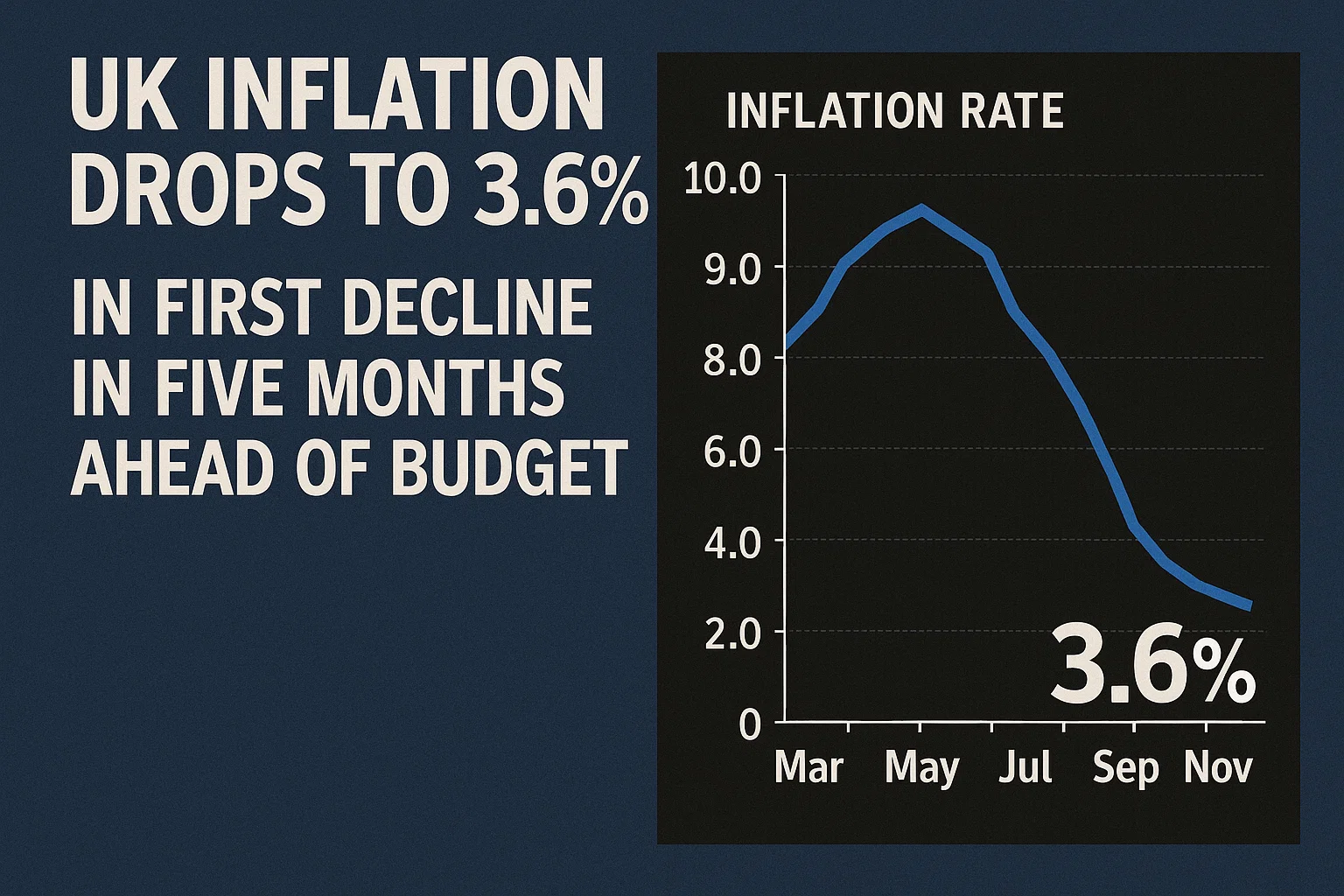

One of the key skills that foreign exchange investors want to develop is the capacity to analyze and interpret records. This consists of understanding economic indicators, such as inflation and hobby charges, and the way they affect forex values. Traders additionally need to be able to investigate charts and identify patterns, that can assist them make knowledgeable buying and selling choices.

Risk Control (Forex Trader)

Risk management is also a vital ability for forex buyers. The forex marketplace is intrinsically treacherous, and investors need on the way to control their chance publicity to keep away from big losses. This consists of setting prevent-loss costs, which routinely lock a change if it gets a positive degree, and the usage of the right function sizing, which ensures that trades are not too huge relative to the trader’s account balance. And will hold to conform as well, with an emphasis on facts analysis and risk management.

The Importance of Education and Training:

Education and schooling are crucial to growing to be a hit forex dealer. Forex trading is a convoluted and passionate market that calls for a deep understanding of various factors that affect forex values. Traders ought to apprehend economics, economic markets, and technical analysis to make knowledgeable buying and selling selections.

Many resources are to be had for aspiring foreign exchange investors, along with online publications, webinars, and trading books. Some brokers also offer academic resources, together with trading structures with demo money owed and marketplace analysis and studies get entry to.

It is vital for traders to constantly analyze and improve their competencies to stay competitive in the marketplace. This includes maintaining up with the modern-day tendencies and traits in the forex market and studying from their personal buying and selling experiences.

The Impact of Regulations:

Forex buying and selling is a worldwide marketplace that operates 24 hours a day, 5 days every week. However, the shortage of a centralized regulatory authority could make tracking and regulating the market tough. This has caused concerns approximately fraud, manipulation, and different unethical practices in the marketplace.

Regulatory bodies have been installed in various international locations to supervise forex buying and selling in response to these worries. These bodies impose regulations on agents and buyers to make sure that they function in a truthful and obvious way.

Regulations can impact the foreign exchange marketplace in diverse ways. For instance, they can require brokers to stick to certain requirements and provide greater safety for traders. However, regulations also can grow the fee for buying and selling and make it more difficult for small traders to enter the marketplace. A fantastic read How Debt Consolidation Affects My Credit Score.

The Impact of Geopolitical Affairs:

Geopolitical occasions, which include wars, political fluctuation, and natural disasters, could have a tremendous effect on the foreign exchange marketplace. These events can reason fluctuations in forex values as investors react to converting economic and political situations.

For example, if a country stories political instability, traders may come to be more careful and circulate their budget to safer currencies. This can cause the cost of the risky use of a’s currency to lower. On the other hand, if a country experiences a financial increase, investors can also turn out to be extra assured and make investments within the united states of America’s currency, causing its cost to increase.

Forex market traders should live knowledgeable approximately geopolitical events and their capability effect in the marketplace. This requires maintaining up with information and tendencies globally and analyzing how they could affect foreign money values.

FAQs About Forex Trader

FAQ 1: What is the Forex market trader?

The Forex market trader is a character or entity who engages in the buying and promoting of foreign currencies in the international forex market. They intend to profit from fluctuations in forex charges by speculating on whether forex will recognize or depreciate in opposition to some other.

FAQ 2: How do the Forex market investors make money?

Forex buyers make cash by capitalizing on modifications in currency exchange prices. They buy a currency at a decreased price and sell it at a higher price, or vice versa, aiming to benefit from the rate distinction. Some investors additionally earn cash through hobby differentials or through presenting trading offerings to others.

FAQ 3: What abilities do I need to come to be a Forex market trader?

To grow to be a Forex trader, it’s miles critical to have a terrific knowledge of economics, monetary markets, and international activities which can affect Forex movements. Strong analytical abilities, discipline, threat management abilities, and emotional control also are critical. Continuous studying and flexibility are keys in this dynamic field. Homepage

FAQ 4: Can All and Sundry end up a successful Forex market dealer?

Yes, everybody can probably turn out to be a successful Forex market trader with dedication, subject, and the proper ability set. However, it calls for significant getting to know, exercising, and enjoying. It’s vital to notice that Forex trading entails dangers, and achievement isn’t assured. It is suggested to start with proper training and step-by-step build information.

Table: Forex Trader Overview

| Information | Description (Forex Trader) |

| Definition | Individuals or entities trading foreign currencies in the global foreign exchange market. |

| Profitability | Profits are made by capitalizing on currency exchange rate fluctuations. |

| Required Skills | Strong understanding of economics, financial markets, and global events, analytical abilities, risk management, and emotional control. |

| Potential Success | Success is possible with dedication, discipline, continuous learning, and practical experience, but it involves risks and no guaranteed outcomes. |