Key Takeaways:

- Silver price trades at $56.40, up 12% this week.

- Structural supply deficit and strong industrial demand underpin gains.

- Technical signals favor continuation, but overbought conditions may trigger pullbacks.

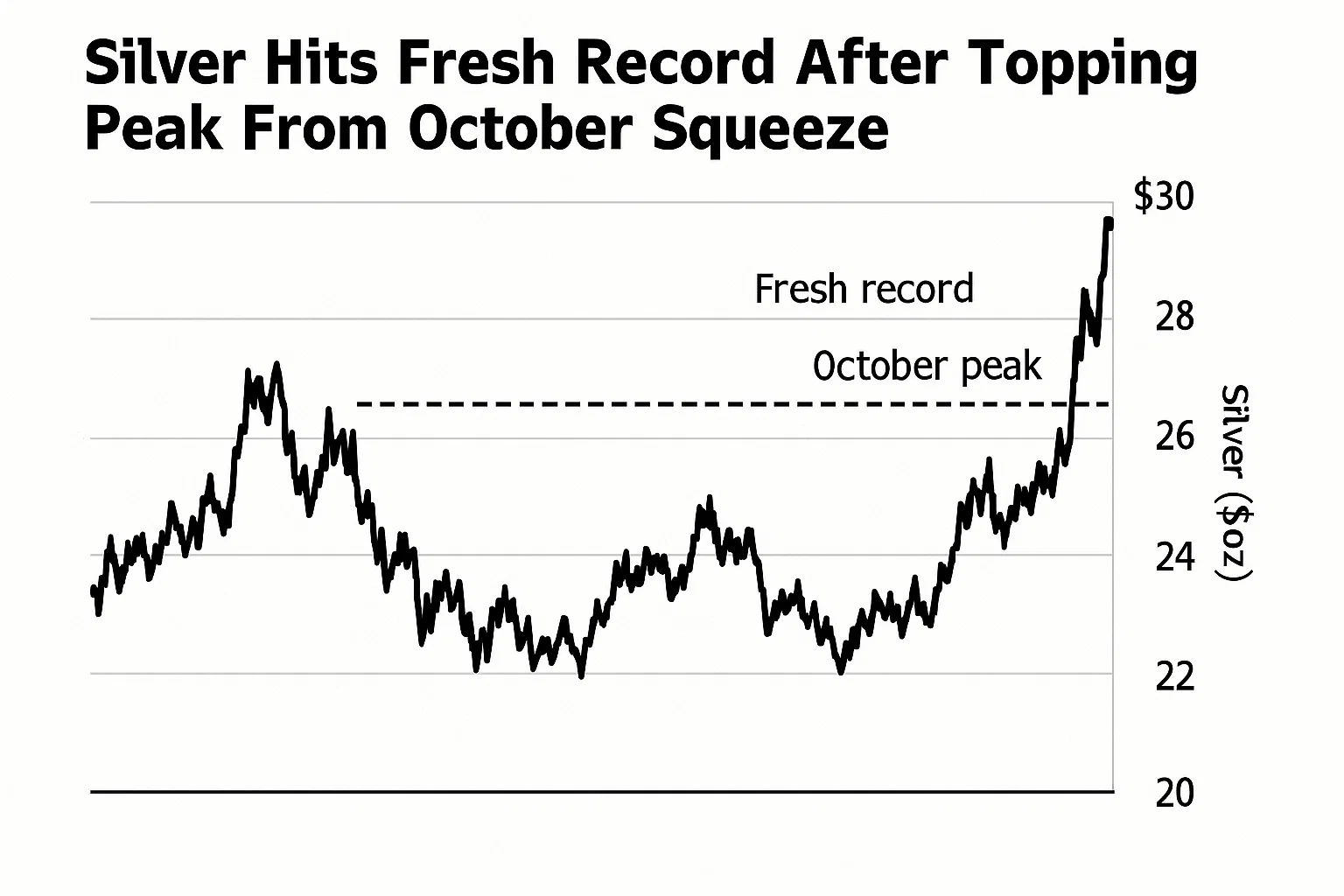

Silver price has surged to a record high above $56 on November 28, 2025, driven by dovish expectations from the Federal Reserve. At $56.40, the precious metal has gained over 12% this week and is set for a seventh consecutive monthly rise. Strong industrial demand and investment interest continue to support this rally, while tightening global supply adds further upward pressure.

Market dynamics indicate that both technical and fundamental factors favor continued bullish momentum. Traders and businesses alike are watching closely as Silver reaches uncharted levels, setting the stage for potential market volatility and strategic investment opportunities.

Factors Driving the Silver Price Rally

Industrial and Investment Demand

Industrial applications remain a key driver of Silver price. The metal is crucial for electronics, solar panels, and medical equipment. Rising global demand, particularly in China and India, is pressuring supply. Investment interest, through ETFs and physical Silver purchases, has also surged. Combined, these factors create a strong foundation for continued price appreciation.

Supply Constraints

Global Silver inventories are tightening, reinforcing the price surge. Shanghai Futures Exchange warehouses report the lowest inventory levels since 2015, while physical turnover on the Shanghai Gold Exchange has fallen to a nine-year low. According to the Silver Institute, 2025 is on track to be the fifth consecutive year of a structural supply deficit, as mining output and recycling struggle to meet rising demand.

| Supply Metric | Current Level | Historical Reference |

|---|---|---|

| Shanghai Warehouse Inventory | Lowest since 2015 | 2015 |

| Physical Silver Turnover | 9-year low | 2016 |

| Structural Supply Deficit | 5th consecutive year | 2021-2025 |

Technical Analysis of Silver Price

Bullish Momentum Indicators

From a technical perspective, Silver has broken out from a falling wedge pattern, indicating strong bullish momentum. The 21-day Simple Moving Average (SMA) at $50.72 acts as immediate support, while the 50-day and 100-day SMAs remain lower.

Momentum indicators reinforce the trend: the MACD is above the Signal line, and the Relative Strength Index (RSI) has entered overbought territory at 71. combination signals potential for further gains while highlighting short-term caution for pullbacks.

Key Support and Resistance Levels

Support is expected between $55.00 and $54.00, with a deeper fallback near $50.70-$50.00. Resistance is primarily psychological, as Silver price navigates new highs. Traders often use these levels to plan strategic entries and exits, minimizing risk while capitalizing on momentum.

Global Factors Affecting Silver Price

US Dollar and Fed Policies

Silver price is inversely related to the US Dollar. A weaker Dollar supports higher Silver prices, while a stronger currency can cap gains. Current dovish Fed expectations have eased interest rate concerns, reducing the appeal of yield-bearing assets and boosting safe-haven metals. This dynamic has contributed significantly to the record high.

Geopolitical and Economic Drivers

Geopolitical tensions and global economic uncertainty also favor Silver. Investors often turn to precious metals during instability, though Silver’s moves are more sensitive to industrial and investment demand compared to Gold. Countries with large industrial sectors, such as the US, China, and India, influence both supply and demand dynamics, directly impacting Silver price trends.

Market Outlook

Analysts anticipate that Silver price could continue its bullish trajectory if supply deficits persist and industrial demand remains robust. While overbought conditions in technical indicators suggest potential short-term corrections, the long-term trend remains positive.

Investors and industrial users should monitor macroeconomic indicators, including Fed decisions, Dollar strength, and global manufacturing trends, to assess price direction. Don’t miss our recent post about Alibaba Launches Quark AI Glasses in China, Joining the Global Wearables Race.

Bottom Line

Silver price has reached unprecedented highs due to strong industrial demand, tightening supply, and dovish Fed expectations. As markets navigate overbought technical conditions, stakeholders must balance short-term caution with long-term opportunity. Businesses reliant on Silver should secure supply proactively, while investors may consider measured exposure. Ongoing monitoring of macroeconomic and industrial trends will be crucial in anticipating future price movements.

Disclaimer:

This article is for informational purposes only and does not constitute financial, investment, or trading advice.