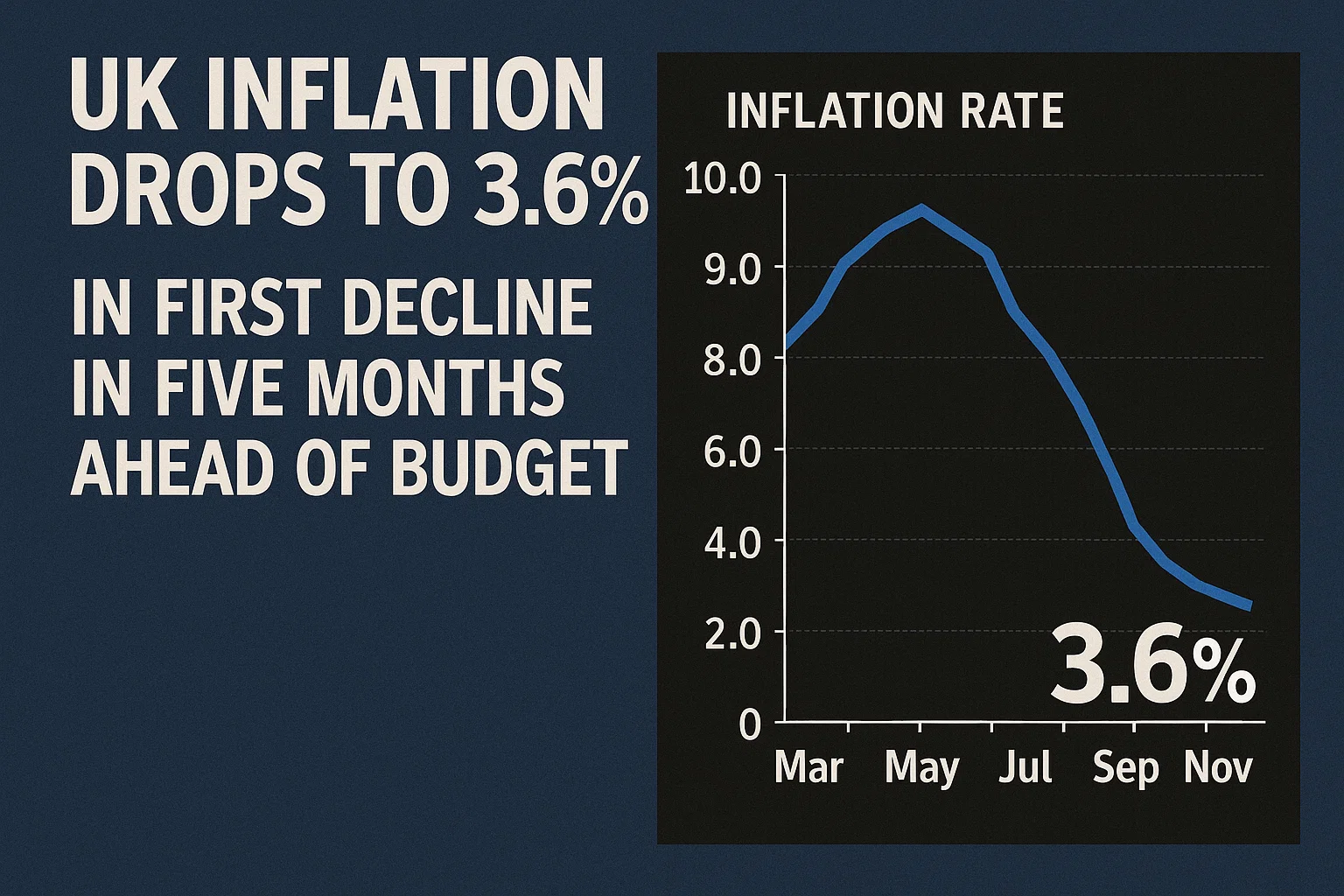

We begin by noting that UK inflation has eased to 3.6% in October, marking the first fall in five months and offering a measure of relief for households and the government alike. This drop in UK inflation comes at a critical moment as the upcoming budget is expected to tackle living-cost pressures, and it sets the tone for the rest of the article.

We explore what drove the decline, what it means, and how the budget may shape the road ahead.

What Led to the Fall in UK Inflation to 3.6%?

Energy, housing and services easing

The drop in UK inflation to 3.6% stems largely from lower energy and housing cost pressures. According to the Office for National Statistics (ONS), the Consumer Prices Index (CPI) rose by 3.6% in the twelve months to October, down from 3.8% in September. Key drivers included lower utility and hotel price increases, which helped drag down the headline rate.

Food costs remain a worry

While many costs eased, food and non-alcoholic drink inflation rose to 4.9% in October from 4.5% in September. This means that, even with inflation falling overall, many households still face strong price rises for everyday essentials.

Core inflation also eased

The measure of inflation that excludes volatile items such as food and energy – often called “core inflation” – fell modestly from 3.5% to 3.4%. This softening suggests domestic price growth pressures might be easing somewhat.

Why the Timing Matters: The UK Budget and Policy Links

Budget backdrop and household pressures

The fall in UK inflation arrives just ahead of the government’s budget. The Rachel Reeves-led Treasury sees this as an opportunity to combine fiscal policy measures with easing inflation to ease cost‐of‐living pressures for households.

With inflation now at 3.6%, the government has more room to manoeuvre and may feel some momentum in making spending or tax moves that help families, while still showing commitment to bringing inflation down further.

Implications for interest rates and monetary policy

For the Bank of England, the decline in UK inflation provides some cover to consider future interest‐rate cuts, especially if growth weakens. Analysts suggest that with inflation likely having peaked, monetary policy may gradually shift.

A lower inflation rate strengthens the argument that the Bank of England will not have to act urgently to raise rates and may instead focus on stability.

What This Means for Households and Businesses

Relief but not yet a full ease

The drop in UK inflation to 3.6% is welcome news for consumers, but it does not mean prices are falling it means they are rising more slowly. For many households, especially those on tight budgets, the pace of price rises remains too high. The rise in food inflation to nearly 5% means many families may still feel the pinch.

Business cost pressures remain

For businesses, a falling inflation rate may signal easing cost pressures, particularly on utilities and services. But because core inflation remains over 3%, companies still face elevated wage, energy, or material cost pressures. Decisions on pricing, investment and wages remain sensitive to inflation trends.

Where Will UK Inflation Head From Here?

Forecasts and expectations

Economists expect that UK inflation has likely peaked, and the risk is now of a gradual decline rather than a sharp drop. According to the MoneyWeek analysis, inflation may move closer to the 2% target over the next year or two. The ONS latest release confirms CPI at 3.6% for October.

Key risks remain

Despite the drop, UK inflation is still well above the government’s 2% target. Risks that could slow the fall include wage growth, imported cost pressures, and food price inflation. Should any of these revise upwards, the decline in UK inflation could stall.

Budget’s role in future inflation trend

The upcoming budget is likely to play a significant role in shaping the future of UK inflation. Measures that reduce cost‐of-living pressures without generating inflationary spurts will support the downward trend. If the government uses the relief from easing inflation wisely by stabilising household budgets and managing public finances the path for UK inflation may remain favourable. Don’t miss our recent post about News.

Final Thoughts

The decline in UK inflation to 3.6% marks a meaningful shift in the price-growth landscape. For households and the government alike, this move offers cautious optimism. Yet the journey is not over with inflation still above target and risks remaining, the coming budget and policy choices will matter deeply. By keeping a watch on UK inflation’s trajectory, we see how fiscal and monetary policy may work together to ease living costs and stabilise the economy.

Frequently Asked Questions (FAQs)

What is the current rate of UK inflation?

Why did UK inflation fall to 3.6%?

Does this mean prices are falling in the UK?

What does this mean for interest rates in the UK?

Disclaimer:

This article is research-based and created for informational purposes only. All data, insights, and analysis are drawn from publicly available sources at the time of writing. We do not provide financial, legal, or professional advice.